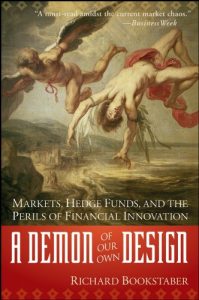

Richard Bookstaber – A Demon Of Our Own Design

$10.00

“…smart book…Part memoir, part market forensics, the book gives an insider’s view…” (Bloomberg News)

Richard Bookstaber – A Demon Of Our Own Design

Check it out: Richard Bookstaber – A Demon Of Our Own Design

Inside markets, innovation, and risk

Why do markets keep crashing and why are financial crises greater than ever before? As the risk manager to some of the leading firms on Wall Street–from Morgan Stanley to Salomon and Citigroup–and a member of some of the world’s largest hedge funds, from Moore Capital to Ziff Brothers and FrontPoint Partners, Rick Bookstaber has seen the ghost inside the machine and vividly shows us a world that is even riskier than we think. The very things done to make markets safer, have, in fact, created a world that is far more dangerous. From the 1987 crash to Citigroup closing the Salomon Arb unit, from staggering losses at UBS to the demise of Long-Term Capital Management, Bookstaber gives readers a front row seat to the management decisions made by some of the most powerful financial figures in the world that led to catastrophe, and describes the impact of his own activities on markets and market crashes. Much of the innovation of the last 30 years has wreaked havoc on the markets and cost trillions of dollars. A Demon of Our Own Design tells the story of man’s attempt to manage market risk and what it has wrought. In the process of showing what we have done, Bookstaber shines a light on what the future holds for a world where capital and power have moved from Wall Street institutions to elite and highly leveraged hedge funds.

Table of Contents

Preface ix

Acknowledgments xvii

About the Author xix

CHAPTER 1 ~ Introduction: The Paradox of Market Risk 1

CHAPTER 2 ~ The Demons of ’87 7

CHAPTER 3 ~ A New Sheriff in Town 33

CHAPTER 4 ~ How Salomon Rolled the Dice and Lost 51

CHAPTER 5 ~ They Bought Salomon, Then They Killed It 77

CHAPTER 6 ~ Long-Term Capital Management Rides the Leverage Cycle to Hell 97

CHAPTER 7 ~ Colossus 125

CHAPTER 8 ~ Complexity, Tight Coupling, and Normal Accidents 143

CHAPTER 9 ~ The Brave New World of Hedge Funds 165

CHAPTER 10 ~ Cockroaches and Hedge Funds 207

CHAPTER 11 ~ Hedge Fund Existential 243

Conclusion: Built to Crash? 255

Notes 261

Index 273

Author Information

Richard Bookstaber runs an equity hedge fund in Greenwich, Connecticut. He was the director of risk management at Ziff Brothers Investments and at Moore Capital Management, one of the largest hedge funds in the world. He served as the managing director in charge of firm-wide risk management at Salomon Brothers and was a member of Salomon’s powerful Risk Management Committee. Mr. Bookstaber also spent ten years at Morgan Stanley in quantitative research and as a proprietary trader, concluding his tenure there as Morgan Stanley’s first market risk manager. He is the author of three books and scores of articles on finance topics ranging from options theory to risk management. Bookstaber received a Ph.D. in economics from MIT.

Reviews

“A risk-management maven who’s been on Wall Street for decades…Bookstaber’s book shows us some complex strategies that very smart people followed to seemingly reduce risk—but that led to huge losses.” (Newsweek)

“Mr. Bookstaber is one of Wall Street’s ‘rocket scientists’–mathematicians lured from academia to help create both complex financial instruments and new computer models for making investing decisions. In the book, he makes a simple point: The turmoil in the financial markets today comes less from changes in the economy–economic growth, for example, is half as volatile as it was 50 years ago–and more from some of the financial instruments (derivatives) that were designed to control risk.” (The New York Times)

“Bright sparks like Mr Bookstaber ushered in a revolution that fuelled the boom in financial derivatives and Byzantine ‘structured products.’ The problem, he argues, is that this wizardry has made markets more crisis-prone, not less so. It has done this in two ways: by increasing complexity, and by forging tighter links between various markets and securities, making them dangerously interdependent.” (The Economist)

“He understands the inner workings of financial markets…A liberal sparkling of juicy stories from the trading floor…” (The Economist)

“…smart book…Part memoir, part market forensics, the book gives an insider’s view…” (Bloomberg News)

“Like many pessimistic observers, Richard Bookstaber thinks financial derivatives, Wall Street innovation and hedge funds will lead to a financial meltdown. What sets Mr. Bookstaber apart is that he has spent his career designing derivatives, working on Wall Street and running a hedge fund.” (The Wall Street Journal)

“Every so often [a book] pops out of the pile with something original to say, or an original way of saying it. Richard Bookstaber, in A Demon of Our Own Design: Markets, Hedge Funds, and the Perils of Financial Innovation, accomplishes both of these rare feats.” (Fortune)

“a must-read amidst the current market chaos” (BusinessWeek.com)

“Bookstaber is a former academic who went on to head risk management for Morgan Stanley and now runs a large hedge fund. He knows the subject and has written a lucid and readable book. To his aid he calls mathematics (from Bertrand Russell to Godel’s theorem); physics (particularly Heisenberg’s uncertainty principle); and even — meteorology.” (Financial Times)

“The book covers a lot about risk management that is relevant to capital markets conditions today and the liquidity crisis.” (Financial Times, Saturday 25th August)

“…an insider’s guide to markets, hedge funds and the perils of financial innovation. We saw plenty of those in 2007.” (The Sunday Telegraph, Sunday 25th November 2007)

“I cannot recommend this book too highly. It is a clear exposition of what the combination of derivatives, leverage and hedge funds can do to the markets.

In short, A Demon of our Own Design is a guide to the dangerous financial markets we have created for ourselves by the clever innovations of structured finance, derivatives, credit default swaps and other newfangled products that are a mystery to the ordinary investor and even plenty of the sophisticates in the investment business. To understand the demonic risks we’re taking, read this book.”